Gender Issues: The Invention of Wings

June 2, 2014

Opportunity Cost & The Meat Eater's Dilemma

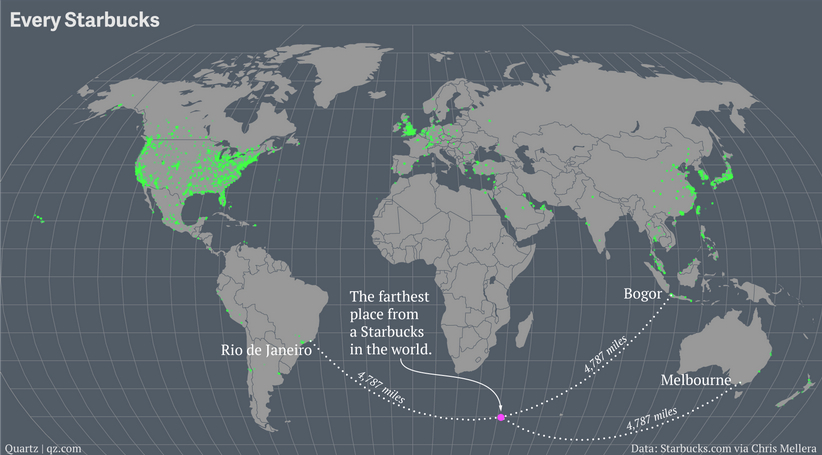

June 4, 2014If you live in northeast Montana, the nearest Starbucks might be 192 miles from home while you could choose among 62 Starbucks between 42nd and 59th Street in Manhattan. Beyond the US, Italy has no Starbucks, Canada has 1396 and China, 1219. And, except for Morocco and Egypt, Starbucks has no stores in continental Africa.

You can see from this worldwide Starbucks map that the US has the most. The US total at the end of May 2014 was 11,563.

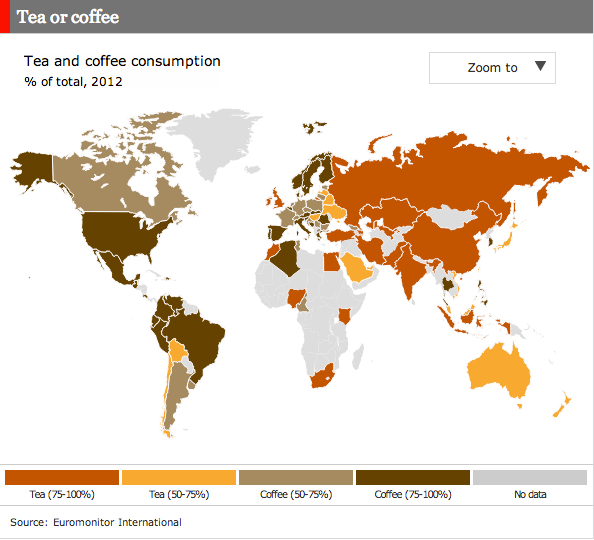

Below, The Economist compares worldwide tea and coffee consumption:

Why are we looking at coffee consumption? Because coffee is perceived as a luxury good in the developing world, it can be a handy economic indicator.

In Uganda, a 28-year old dentist says her 7:30 in-the-morning cup of coffee at a coffee shop is her favorite time of the day. Although Uganda is a tea drinking country and a coffee exporter, the number of “swanky” (a WSJ adjective) coffee shops is growing. Correspondingly, The Economist’s Global Forecasting Service reported that coffee consumption was up 5% to 6% in developing nations. They also point out though that recently “muted economic conditions” have led to less coffee consumption growth.

Our bottom line? 2 economic ideas:

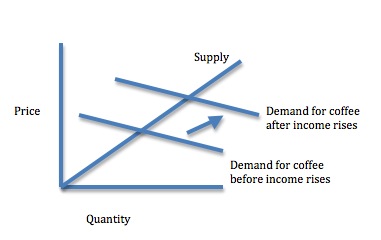

1. Income shifts demand curves: As a luxury good, coffee consumption depends on rising incomes. Consequently, when incomes increase, so too does the demand for coffee.

2. Luxury goods usually have an elastic demand curve: Not only do we have a curve that shifts when income changes but also, because the coffee demand curve itself is somewhat elastic, we sloped it a bit more horizontally. Thinking economically, elasticity means that when price changes by a certain percent, the quantity response takes an even larger leap.

A final thought: With tea possibly making a comeback, could it also become an economic indicator? Please let us know your opinion in a comment.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)