How Safety Can Create Danger

November 16, 2025

The Big Issues With WNBA Expansion

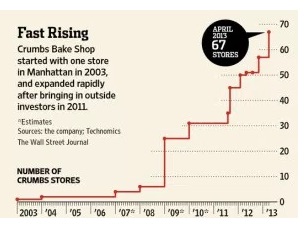

November 18, 2025In 1996, at a small NYC shop called Magnolia, the $3 gourmet cupcake was born. But it took an entrepreneur to start a chain called Crumbs for the bubble to inflate. Believing cupcake consumption was unstoppable, Crumbs’s production and prices shot skyward. They even charged $42 for a giant cupcake that fed eight people…and it sold!

The Huffington Post said we had reached “Peak Cupcake” when a Crumbs IPO let all of us join the frenzy. At first the stock was $13.10 a share during June of 2011. By June 30, 2014, it had plunged to 4 cents a share and Crumbs was closing all of its shops.

Is AI going to be a cupcake?

An AI Bubble

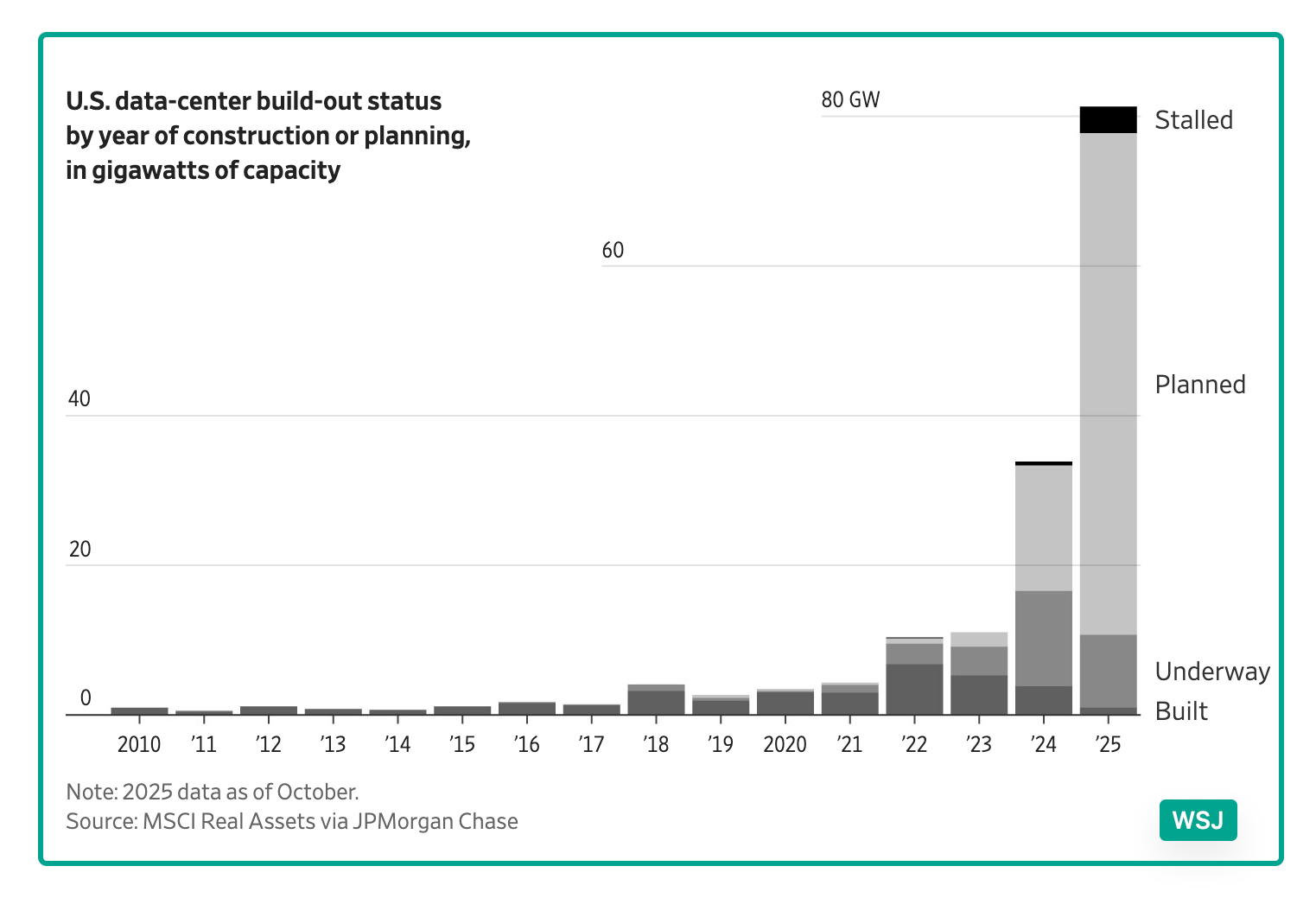

Focusing on AI data centers, a Bloomberg Odd Lots podcast explained why we could be experiencing a bubble.

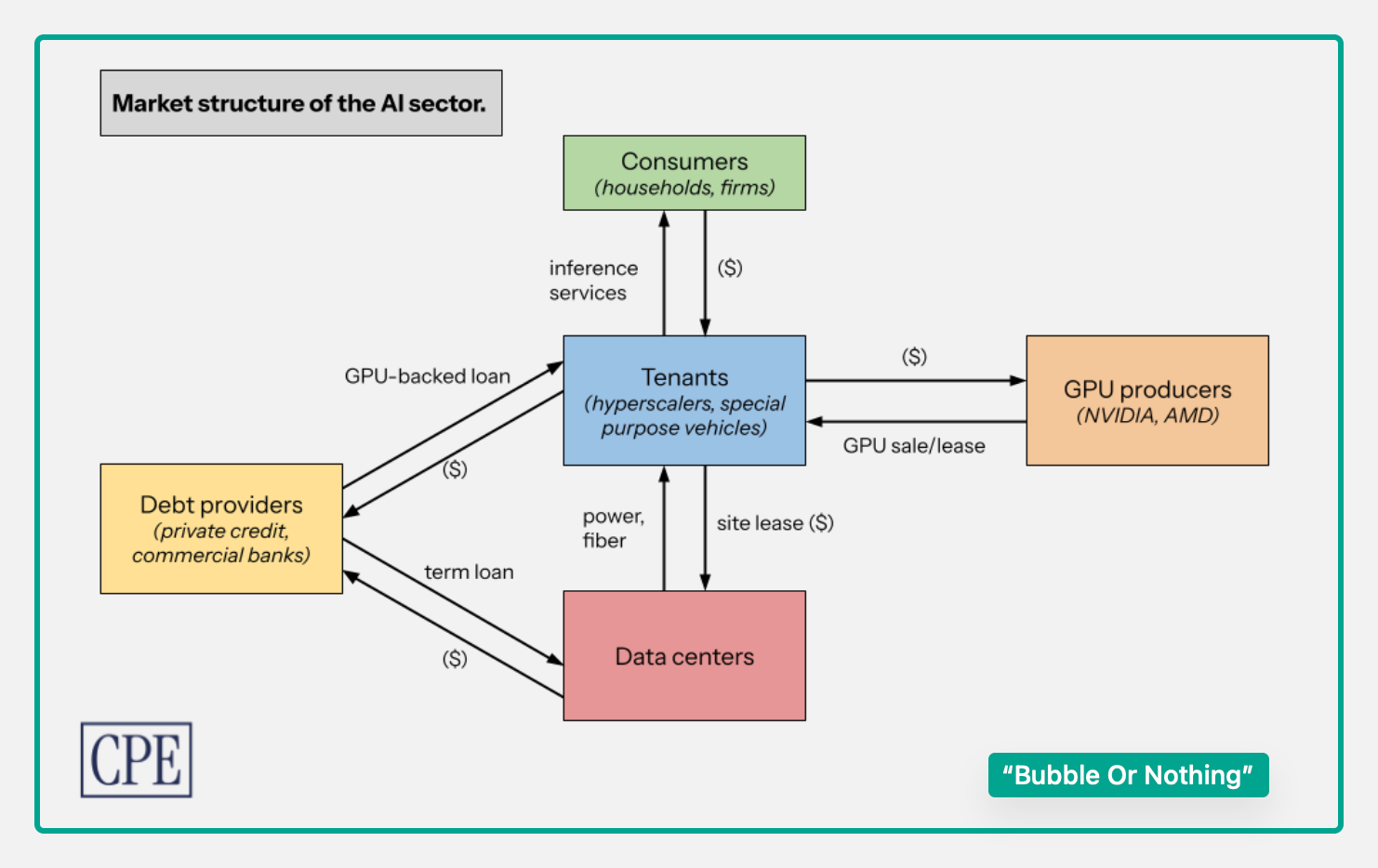

For starters, we can perceive an AI data center as an apartment building with one or many tenants. It could be owned by a Google that moves into the entire space, or many smaller occupants. Varied, depending on the chips they use, those occupants determine the life of the data center and the power it uses.

Debt providers, consumers, tenants, data centers, and GPU producers populate the AI market structure:

Next, if we added dollars and firms to our graphic, one example would be Anthropic’s $50 billion AI data center commitment. Only a small slice of the money heading to AI from many firms, the initiative is typical for its size and indefinite future. Later on their discussion, Odd Lots tells us that Amazon hit a bit of a glitch in Oregon when the grid could not provide the power they said they were promised for their new AI data centers.

Amazon is only one of the tech giants that has big AI plans:

More precisely, data centers will play a central role:

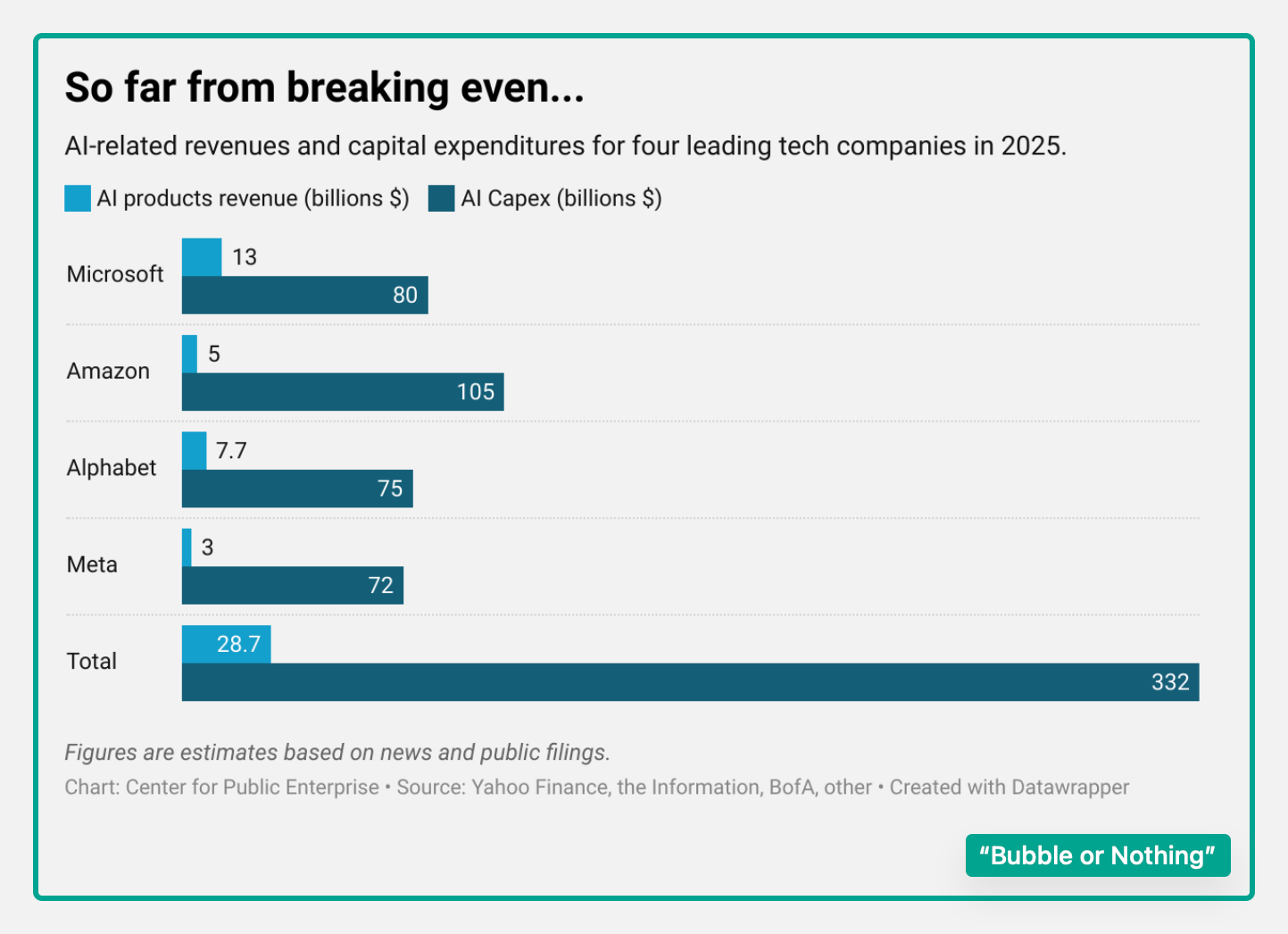

According to a recent report from the Center For Public Enterprise, data center investing is worrisome for four reasons. Because AI’s competitive market structure has minimal differentiation, firms don’t have enough pricing power to cover their costs. Competition also could depress the value of their chips from unsure demand and development pressures. Combined with the recurring capital needs of data centers and the up- and downsides of circular financing through which the “landlords” and tenants invest in each other, we wind up with vulnerable financing.

The Center For Public Enterprise estimated the current cost and revenue gap:

China

As a final consideration, Odd Lots suggests competition with China’s AI development leaves us with no alternative but to feed our own development.

Our Bottom Line: Bubbles

Bubbles start with something new that captivates the market. It could be real estate, technology, or easy credit. As euphoria builds, so too do demand driven price increases. Then, with speculative purchases escalating, prices move even higher. But always, the euphoria switches to panic, sellers multiply and the market crashes. On the way up, participants like to say “This time it’s different.”

Deciding if AI is at the bubble stage, we can assess its connection to real estate, technology, and easy credit.

And cupcakes?

My sources and more: It’s always a delight when a podcast and a news article combine to make 1+1=3. This week, an Odd Lots podcast and WSJ looked at the AI potential for a bubble. From there, we went to a report (wonderfully called “Bubble or Nothing”) from the Center For Public Enterprise.

We should note that several of today’s sentences were previously published at econlife.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)